Free Capital Gains Tax Calculator - Estimate Your Tax Liability

Our comprehensive capital gains tax calculator helps investors estimate their tax liability on investment profits before selling stocks, bonds, or other securities. Understanding your potential capital gains tax is crucial for effective tax planning and maximizing your after-tax returns from investments.

This capital gains calculator distinguishes between short-term and long-term capital gains, which are taxed at different rates. Short-term gains (assets held for one year or less) are taxed as ordinary income, while long-term gains (assets held for more than one year) benefit from preferential tax rates that can significantly reduce your tax burden.

Whether you're planning to sell stocks, real estate, or other investments, our capital gains tax calculator provides accurate estimates to help you make informed decisions about timing your sales, harvesting tax losses, or planning your overall investment strategy for optimal tax efficiency.

Capital Gains Tax Calculator

Calculate your tax liability on investment profits

Investment Details

Tax Details

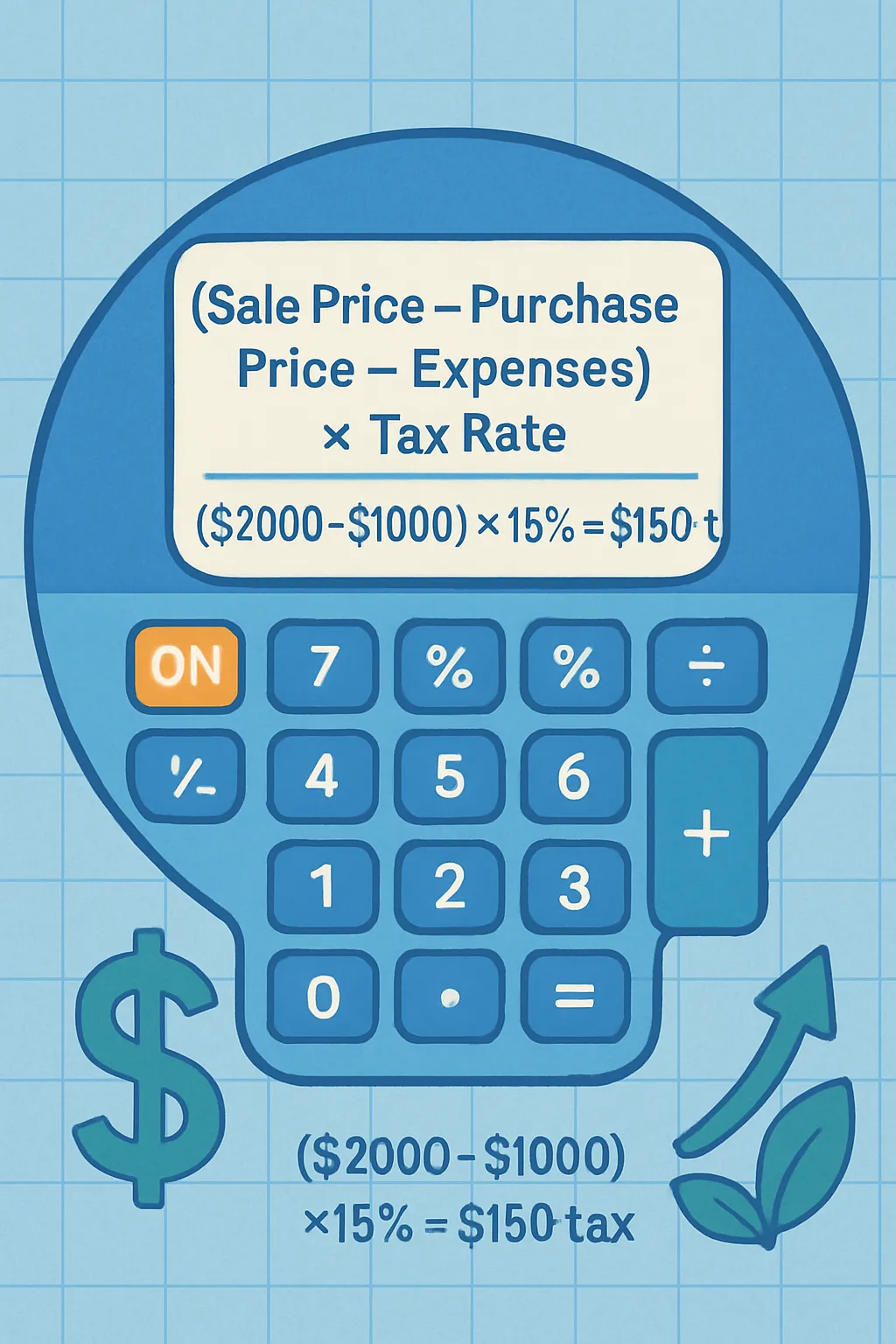

💰 How Capital Gains Tax Calculation Works

Visual guide to understanding capital gains tax calculations and tax implications

Frequently Asked Questions

Capital gains tax is a tax on the profit realized on the sale of a non-inventory asset. For stocks, it's the tax you pay on the profit you make when you sell your shares.

Short-term capital gains are profits from assets held for one year or less and are taxed at your ordinary income tax rate. Long-term capital gains are from assets held for more than one year and are taxed at lower rates.