Free Options Profit Calculator - Calculate Call & Put Profits

Our comprehensive options profit calculator is an essential tool for options traders who need to calculate potential profits and losses on call and put options. Whether you're trading weekly options, monthly contracts, or LEAPS, this calculator helps you analyze the risk-reward profile of your options trades before you commit capital.

This options profit calculator works for both call and put options, allowing you to input strike prices, premiums paid, number of contracts, and current stock prices to determine your potential profit or loss at expiration. Understanding your break-even points and maximum profit potential is crucial for successful options trading strategies.

Use our free options profit calculator to evaluate covered calls, cash-secured puts, long calls, long puts, and other options strategies. Perfect for both beginner and advanced options traders who want to make informed decisions and manage risk effectively in the options market.

Options Profit Calculator

Calculate potential profits and losses for call and put options

Option Details

Trading Details

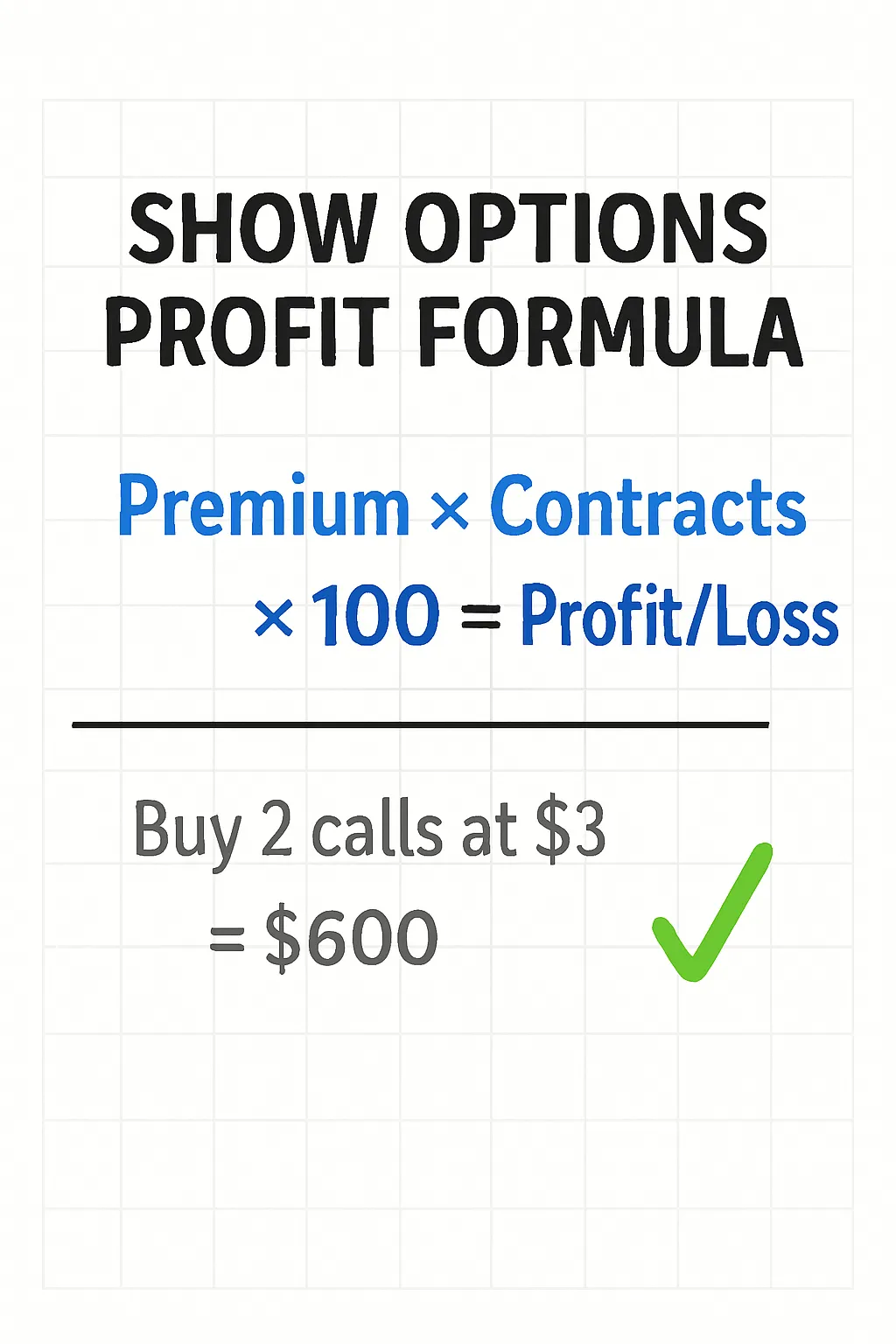

💹 How Options Profit Calculation Works

Visual guide to understanding options profit calculations and trading strategies

Frequently Asked Questions

A stock option calculator is a tool that helps traders determine the potential profit or loss of an options contract at different stock prices upon expiration. It helps in understanding the risk and reward of a trade.

Select the option type (call or put), enter the strike price, the premium (price you paid for the option), and the number of contracts. The calculator will then show you the break-even point and potential profit or loss.